The Ultimate Guide to Wireless Card Machines: Benefits, Features, and Why Your Business Needs One

In today’s fast-paced, digital-first world, customers expect convenience, speed, and flexibility—especially when it comes to making payments. This is where wireless card machines step in as a game-changer for businesses of all sizes. Whether you’re a street vendor, a café owner, or manage a fleet of delivery drivers, adopting wireless payment solutions can drastically improve customer experience and streamline your operations.

In this comprehensive blog, we’ll explore everything you need to know about wireless card machines—including how they work, their advantages, key features to look for, and how to choose the right one for your business.

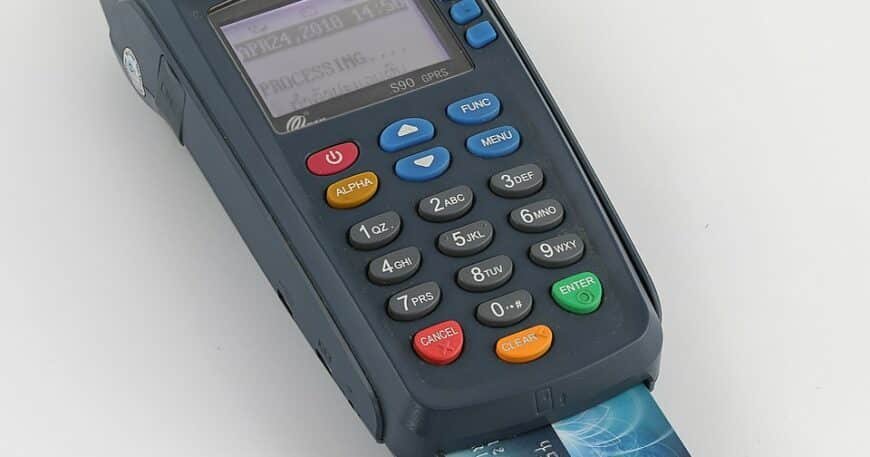

What is a Wireless Card Machine?

A wireless card machine, also known as a mobile card reader or portable payment terminal, is a device that allows businesses to accept card payments without being tethered to a fixed location or wired internet connection. These machines connect through Wi-Fi, Bluetooth, or mobile networks (3G, 4G, or 5G), offering the flexibility to accept payments anywhere, anytime.

They can process payments from:

- Credit cards

- Debit cards

- Contactless cards

- Mobile wallets (Apple Pay, Google Pay, Samsung Pay)

How Wireless Card Machines Work

- Connection: Wireless card readers use a secure internet connection (via Wi-Fi, mobile data, or Bluetooth paired to a phone/tablet) to transmit payment data.

- Payment Initiation: The customer taps, swipes, or inserts their card or mobile wallet.

- Data Processing: The terminal sends encrypted data to the payment processor.

- Approval: The payment is approved or declined within seconds.

- Receipt: Customers can receive a printed or digital receipt instantly.

Benefits of Wireless Card Machines

1. Mobility and Flexibility

With no cables or fixed internet lines, you can take payments on the go—at customer tables, markets, festivals, or even on delivery routes. This is ideal for:

- Food trucks

- Market stalls

- Service providers like electricians, plumbers, or taxi drivers

2. Faster Checkout

Wireless card machines allow for quicker transactions through contactless payments, reducing long queues and improving customer satisfaction.

3. Improved Customer Experience

Customers love options. Offering a fast, secure, and convenient way to pay builds trust and encourages repeat business.

4. Easy Setup and Use

Most modern wireless card machines are plug-and-play with intuitive interfaces. You can start accepting payments in minutes.

5. Real-Time Reporting

Many wireless terminals come with cloud-based dashboards that give you real-time access to sales reports, helping you monitor and optimize your business performance.

Key Features to Look For in a Wireless Card Machine

Not all wireless payment machines are created equal. Here are the must-have features to consider before purchasing or renting one:

1. Connectivity Options

Look for terminals that offer multiple connectivity methods: Wi-Fi, Bluetooth, and mobile data (with built-in SIM card).

2. Battery Life

Battery life is crucial for mobile businesses. Aim for a terminal with at least 8-12 hours of continuous use.

3. Multi-Payment Compatibility

Ensure the machine supports:

- Chip & PIN

- Contactless (NFC)

- Magstripe

- Mobile payments

4. Receipt Printing or Digital Options

Depending on your business type, you may need a built-in printer. Alternatively, consider options that send digital receipts via SMS or email.

5. Security Compliance

Choose a terminal that meets PCI-DSS and EMV standards to ensure secure transactions and data protection.

6. Integration with POS and Inventory

Some card machines integrate with your Point-of-Sale system or even inventory tracking, simplifying business operations.

Popular Wireless Card Machine Brands and Models

Here are some of the top-rated wireless card machines used globally:

- Square Terminal – Sleek design, Wi-Fi-enabled, and includes a touchscreen.

- SumUp Air – Budget-friendly and Bluetooth-powered, great for small vendors.

- iZettle by PayPal – Intuitive, fast, and excellent for small businesses.

- Ingenico Move/5000 – Feature-rich and robust for high-volume businesses.

- Verifone V400m – Secure, reliable, and packed with connectivity features.

Use Cases Across Industries

Wireless card machines aren’t just for retail. Here’s how various industries benefit:

1. Retail

Speed up checkout, reduce counter congestion, and serve customers anywhere in the store.

2. Hospitality

Allow customers to pay at their table, improving service efficiency and tipping.

3. Events & Festivals

Sell merchandise, tickets, or food and drinks on-site without needing power outlets or internet lines.

4. Delivery Services

Let drivers collect payments at the customer’s doorstep, eliminating the need for cash.

5. Freelancers and Professionals

Accept payments during client visits, at workshops, or pop-up locations.

Costs Involved

The cost of wireless card machines can vary depending on your needs:

- Upfront cost: $0–$500 (Some providers offer rental models)

- Transaction fees: 1.5% to 3% per transaction

- Monthly fees: Some devices have no monthly fee, while others include advanced features for a subscription

Always compare providers and read the fine print to avoid hidden charges.

How to Choose the Right Wireless Card Machine for Your Business

Ask yourself the following questions:

- Do I need a built-in printer?

- Will I need mobile network (4G/5G) access or just Wi-Fi?

- Do I want a pay-as-you-go model or fixed monthly fees?

- How much customer traffic do I expect?

- Do I need additional features like inventory tracking or POS integration?

Based on your answers, shortlist 2–3 card machines and compare their specs, reviews, and costs.

Final Thoughts

As cash continues to decline and digital payments become the norm, investing in a wireless card machine is not just a luxury—it’s a necessity. It enhances mobility, improves customer experience, and helps your business stay competitive in today’s dynamic market.

Whether you’re a startup or a well-established business, choosing the right wireless payment solution can unlock new revenue opportunities and customer satisfaction.

FAQ

Q: Can I use a wireless card machine without a smartphone?

Yes, many models are standalone and come with built-in connectivity and screens.

Q: Is it safe to use wireless card machines?

Absolutely. As long as your machine is PCI-compliant and uses encrypted data transmission, it’s very secure.

Q: What happens if I lose connection mid-transaction?

Most machines queue the transaction and process it once the connection is restored.

Q: Can I accept international cards?

Yes, most wireless terminals support global card networks like Visa, Mastercard, and American Express. Dojo Payments